By: Tooba Sikandar

The release of the Budget 2025 26 has elicited varied responses amongst the citizens in the nation.

Though the government argues that the new budget is formulated with an intention to ensure economic growth, lesser debt and spur creation of employment, many common citizens are left questioning: Will this budget provide any relief to the common life? In this article, we will discuss the important elements of the budget and also look at how these measures it contains can be converted into actual benefits to the common man.

The tax measures proposed in the budget are to relax the tax structure on the low and middle-income earners. On the salaried employees, minor tax cuts have been established. To take an illustration, individuals who earn specific amounts of income will have their tax rates lowered relative to the past years. The government workers will also enjoy 10 percent pay and pension increment. These developments will come as good news to a group of the population whose incomes are fixed and very vulnerable to the levels of taxation and marginal increases. Nevertheless, although these measures provide a degree of relief to those on salaries and those in government employment, a large proportion of workers and self-employed people, particularly those in the informal sector, will not experience the equivalent relief, given that they are not always within the immediate targets of these interventions.

Off the adjustments in income tax, the budget attempts in some ways to deal with social safety nets and subsidies. The traditional welfare programs that have supported quite a number of vulnerable families are set to continue. Funding levels of these programs have however not been increased substantially. It may not be a marginal increase in social welfare funds that is needed in this day and age where the daily costs of living are ever increasing i.e. the cost of food, medical care, education etc. Although modest increases in health and education expenditure may potentially have benefits in terms of improving public services in the longer run, the short-term effect on cost of living is likely to be small.

The other important thing about the budget is the way it plans to address inflation and cost of living. Although the government has been attempting to contain inflation, it is predicted that the inflation rate may languish at about 7.5 percent in the next few months. This translates to the fact that the cost of basic products like grocery, fuel and utilities will continue to increase. To the majority of ordinary citizens, rising cost of living automatically eats up the purchasing power and it becomes hard to stretch household budgets. Although the idea of tax cuts on some income groups is a good initiative, the increasing prices are likely to overcompensate the benefit of such measure.

The new budget also has defense spending as one of its top priorities and as such, national security is set to increase by a huge margin. Although the country needs a good defense, these huge spending cuts tend to limit the financial space in which social and economic activities can be undertaken. Opponents claim that this money would have been better spent on increasing subsidies, enhancing publicly funded healthcare, or enhancing infrastructure in rural and underdeveloped regions. Defense priorities in a country where a large percentage of the population is concerned with subsistence needs might appear to be out of touch with the realities that many citizens face in their daily lives.

The budget also focuses on infrastructure and development projects and allocates money towards public sector development projects and health and education enhancement. At surface value, such investments may represent improved services, newer facilities, and new employment opportunities in the long run. It however takes time before the effect of these projects is felt. In the short-run, some communities may experience improved roads, schools, or hospitals but many ordinary citizens would not experience changes in their everyday lives. This mismatch between long-term development objectives and short-term relief is a common problem in policy implementation.

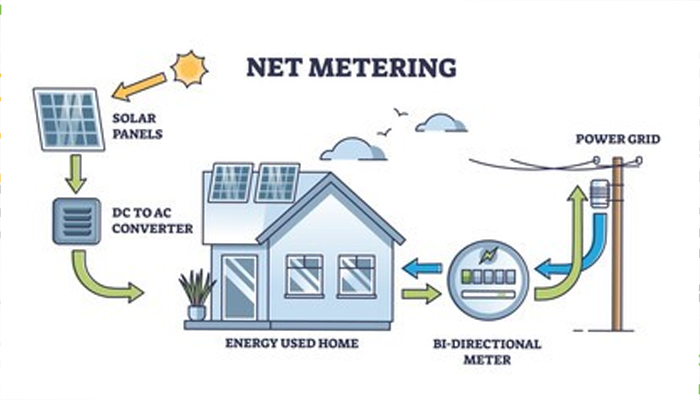

Expansion of tax base by the government is one of the more ambitious elements of Budget 25 26. The introduction of new taxes on digital transactions, real estate, and even solar panel imports will likely boost government revenues, hence contributing to a decrease in the fiscal deficit. Broaden the tax base, on the one hand, is a key to healthier economy and a more stable government. Conversely it may imply, placing new financial burdens on small business, farmers, and individual taxpayers who have historically been exemption or lowly taxed. To some, these new taxes may represent a disappointment, particularly within a struggling economy.

The budget has split public opinion. Certain analysts and business organizations are grateful as fiscal policies are being honed and they say that a brighter economic future can be achieved through targeted tax relief and restrained spending. They believe that the government is pursuing policies that are aimed at making the country friendlier to investment as well as modernizing the economy, which will ultimately trickle down to impact all sectors of society. The opinion of many grassroots activists, opposition leaders, and citizens is, however, skeptical. They highlight that on paper the budget may seem progressive but the benefits of the average citizen are minimal and can be consumed by the increments of Living expenses and other taxes on ordinary commodities.

Among the most notable aspects of critique is that the budget is over-optimistic in the promises of economic growth in the long-term withoutcatching up with the financial difficulties in the present. The ordinary citizen needs relief most at the grocery store, at the clinics or in the schools where the increase in fees is a daily concern. Unless the budget significantly expands cash transfers, subsidized services, or other special assistance to low-income families, there is widespread concern that the current budget will do little to alleviate the daily financial burden.

Besides, tax reductions and pay raises might provide some relief, but such policies often only help a limited percentage of people. Most of the workers in the country, especially those in the informal sector, are essentially unmoved by variations in official taxation policy. In the villages, where most citizens depend on farming and petty commerce, the reforms contained in the budget may not amount to anything tangible. The increase in the cost of input and the instability of market prices imply that a slight increase in household income might be gobbled up by the everyday costs.

In the grand scheme of things, Budget 2025 26 can be seen as an indication of a continuing policy argument regarding how to most appropriately strike a balance between fiscal prudence and the necessity to assist the weak. Though it is true that decreasing the fiscal deficit and raising more revenue is essential to the overall welfare of the economy, it has to be balanced with the urgent needs of the population. The idea of a more secure economic future is abstract and remote to many when they face the reality of making ends meet.

Conclusively, Budget 25 26 may seem to present a bag of both good and bad news to the common people. On the upside, the implementation of tax cuts on salaried employees and a modest salary increment on government employees is a step forward. Infrastructure investments and selective enhancements in health and education can spur long-term development. But with the high inflation rate, the indirect taxes raised, and the defense expenditure still given much preference, there are very grave doubts as to whether the most needy sectors of society will actually experience the relief that the new budget is destined to bring about.